queens economy economic forecast 2012 queens

Economic Outlook 2012 - Queens Economy

Federal Reserve Economist Discusses 2012 Outlook At LIC Partnership Breakfast

Federal Reserve Economist Discusses 2012 Outlook At LIC Partnership Breakfast

February 13, 2012 / Long Island City / Queens Business / Queens Buzz. I attended a lecture given by New York Federal Reserve Economist Rae Rosen at the LIC Partnership breakfast in Long Island City. In the lecture the economist talked about many of the critical factors that would play a role in the outcome of how the economy would perform in 2012. How these factors play out will ultimately impact the kind of economic year Queens, NYC and NYS will have in 2012.

In the photo to your right is Rae Rosen, NY Federal Reserve economist.

U.S. Economic Performance in 2012 Vs Averages

The U.S. economy grew 2.8% in the fourth quarter, ending the 2011 year on a strong note, after a slow beginning. For 2012 the consensus forecast is between 2.5% to 3%, with the highs above 3% and the lows just above 1% which still implies a growth year. The U.S. average growth rate since the end of WWII has been about 3.28%. According to one report I read, the probability the U.S. will slip back into recession has fallen to 23%.

Click here for our report of the lecture given by Federal Economist Rae Rosen at the LIC Partnership breakfast in February 2012 - Queens Economic Forecast 2012.

Economic Outlook 2012 For Queens, NYC & NYS

Federal Reserve Economist Discusses 2012 Outlook At LIC Partnership

Federal Reserve Economist Discusses 2012 Outlook At LIC Partnership

Continued. February 13, 2012 / Long Island City / Queens Business / Queens Buzz. After a little breakfast and an introduction by the LIC Partnership Chair, Gary Kesner, we all watched a slide presentation while the Federal Reserve economist told the story behind the charts.

You may view the slide show below, although I've accompanied the narrative with thumbs to view in tandem. Please note that the accompanying narrative also includes a few factoids that I researched myself.

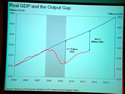

Slide 3493. The economist talked about how the U.S. has returned to producing at the same level it had a few years ago when this recession first took root at the end of 2007. The recession officially ended in June of 2009, but the economy hasn’t added jobs back so quickly due to productivity increases that companies have been able to get via the use of new technologies and different operating strategies.

Slide 3493. The economist talked about how the U.S. has returned to producing at the same level it had a few years ago when this recession first took root at the end of 2007. The recession officially ended in June of 2009, but the economy hasn’t added jobs back so quickly due to productivity increases that companies have been able to get via the use of new technologies and different operating strategies.

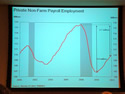

Slide 3496. The economy shed 8.8 million jobs at the peak of the downturn and has added back 3.1 million jobs, so the nation is producing the same as at the peak of its output, with far fewer jobs.

Slide 3496. The economy shed 8.8 million jobs at the peak of the downturn and has added back 3.1 million jobs, so the nation is producing the same as at the peak of its output, with far fewer jobs.

Slide 3497. She talked about the growth rate of the economy since the recession.

Slide 3497. She talked about the growth rate of the economy since the recession.

Slide 3498. And then the post recession growth rates versus prior recessions. She commented that the trend line for the U.S. may reflect some of the structural changes in the economy, which she began commenting on.

Slide 3498. And then the post recession growth rates versus prior recessions. She commented that the trend line for the U.S. may reflect some of the structural changes in the economy, which she began commenting on.

Slide 3499. Housing prices boom and bust. Housing prices, after years of strong double digit growth, experienced a number of years of double digit declines. They picked up a bit in 2010 and fell back again in 2011. She noted that NYC and NYS didn’t get hit as badly as many other areas because prices didn’t rise as much and hence haven’t fallen as much. But – she noted – there are some neighborhoods in Queens that are still in trouble.

Slide 3499. Housing prices boom and bust. Housing prices, after years of strong double digit growth, experienced a number of years of double digit declines. They picked up a bit in 2010 and fell back again in 2011. She noted that NYC and NYS didn’t get hit as badly as many other areas because prices didn’t rise as much and hence haven’t fallen as much. But – she noted – there are some neighborhoods in Queens that are still in trouble.

Slide 3501. One of the factors contributing to the slow job growth recovery is that the U.S. economy has a equity debt overhang from the housing market. About $700 billion in negative equity is still on the books.

Slide 3501. One of the factors contributing to the slow job growth recovery is that the U.S. economy has a equity debt overhang from the housing market. About $700 billion in negative equity is still on the books.

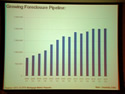

Slide 3504. She noted that there’s been a growing foreclosure pipeline. And she talked about the different rates with which states were processing foreclosures. In NYS it takes two years, in NJ it takes a year and in TX you’re out in 30 days. As most households only have about two months extra cash on hand, once they get to three months behind on payments, it’s hard for them to make it back.

Slide 3504. She noted that there’s been a growing foreclosure pipeline. And she talked about the different rates with which states were processing foreclosures. In NYS it takes two years, in NJ it takes a year and in TX you’re out in 30 days. As most households only have about two months extra cash on hand, once they get to three months behind on payments, it’s hard for them to make it back.

Slide 3505. She noted that one of the factors contributing to housing prices and sales volume is bank lending standards. During the height of the downturn there was a huge gap between those seeking loans versus those who could meet the qualifications for them. That has moderated as demand has slowed and the standards have begun to improve.

Slide 3505. She noted that one of the factors contributing to housing prices and sales volume is bank lending standards. During the height of the downturn there was a huge gap between those seeking loans versus those who could meet the qualifications for them. That has moderated as demand has slowed and the standards have begun to improve.

Slide 3506. Although lending is not as restrictive as it had been, banks are still holding loan applicants to an above average standard, as historically about 25% of approved loan applicants had FICO scores above 760 and today the number is about 50%.

Slide 3506. Although lending is not as restrictive as it had been, banks are still holding loan applicants to an above average standard, as historically about 25% of approved loan applicants had FICO scores above 760 and today the number is about 50%.

Slide 3508. The restrictive lending practices have lead to slower housing starts, one of the major engines of an economic recovery. Not only does it increase jobs, but the home buyers tend to purchase all sorts of other things that go with a new home like furniture and other household and house related items.

Slide 3508. The restrictive lending practices have lead to slower housing starts, one of the major engines of an economic recovery. Not only does it increase jobs, but the home buyers tend to purchase all sorts of other things that go with a new home like furniture and other household and house related items.

Slide 3509. Hence in the current economy, real estate investment is flat, versus other recoveries where it resumed. Currently housing starts are running at around 400,000 per year.

Slide 3509. Hence in the current economy, real estate investment is flat, versus other recoveries where it resumed. Currently housing starts are running at around 400,000 per year.

Slide 3511 & 3513. During the boom, consumers spentfreely because their biggest investment, their home,grew quickly in value.Since the recession began the value of homeowners’ equity declined, and hence they started spending less and saving more.

Slide 3511 & 3513. During the boom, consumers spentfreely because their biggest investment, their home,grew quickly in value.Since the recession began the value of homeowners’ equity declined, and hence they started spending less and saving more.

Slide 3514. The loss of home equity resulted in a spending and economic slowdown and will be a continuing factor, but as things have stabilized, its impact has and will continue to abate.

Slide 3514. The loss of home equity resulted in a spending and economic slowdown and will be a continuing factor, but as things have stabilized, its impact has and will continue to abate.

Slide 3515. State and local governments are spending considerably less. This also impacts the creation of jobs in the recovery.

Slide 3515. State and local governments are spending considerably less. This also impacts the creation of jobs in the recovery.

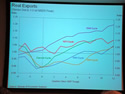

Slide 3516. Exports have come back strong and are a positive contributing factor. She added a bit of caution, stating that Europe is one of our largest trading partners and the growth of their economies will impact ours.

Slide 3516. Exports have come back strong and are a positive contributing factor. She added a bit of caution, stating that Europe is one of our largest trading partners and the growth of their economies will impact ours.

Slide 3517. Another bright spot is that initial jobless claims have been falling to a level where the economy is beginning to create jobs at a faster rate than workers are entering the workforce. Hence unemployment rates have been falling over the course of the year. Although for NYS and NYC and Queens the unemployment rates in 2011 remained fairly steady hovering around 8%.

Slide 3517. Another bright spot is that initial jobless claims have been falling to a level where the economy is beginning to create jobs at a faster rate than workers are entering the workforce. Hence unemployment rates have been falling over the course of the year. Although for NYS and NYC and Queens the unemployment rates in 2011 remained fairly steady hovering around 8%.

Slide 3518. Another contributing factor is that fewer people are looking for jobs. This could be that some have retired, some have gone back to school and some have given up. The participation rate dropped from below 67% to above 64% since the recession began in 2007. National unemployment went from above 10% at the peak, to about 8% now.

Slide 3518. Another contributing factor is that fewer people are looking for jobs. This could be that some have retired, some have gone back to school and some have given up. The participation rate dropped from below 67% to above 64% since the recession began in 2007. National unemployment went from above 10% at the peak, to about 8% now.

Slide 3520. The hours worked are another positive sign, as they are at pre-recession levels, showing that people are putting in a lot of hours, and new hires will be needed to increase output.

Slide 3520. The hours worked are another positive sign, as they are at pre-recession levels, showing that people are putting in a lot of hours, and new hires will be needed to increase output.

Slide 3522. Another contributing factor is that productivity spiked as employers laid off many in their workforce, getting those who remained to produce the same amount with fewer resources. Due to the demand for jobs, wages have not grown much, and this too will weigh on consumer spending. She noted that many businesses [large] are sitting on a lot of cash which at some point they will either have to invest or spin out in dividends.

Slide 3522. Another contributing factor is that productivity spiked as employers laid off many in their workforce, getting those who remained to produce the same amount with fewer resources. Due to the demand for jobs, wages have not grown much, and this too will weigh on consumer spending. She noted that many businesses [large] are sitting on a lot of cash which at some point they will either have to invest or spin out in dividends.

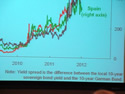

Slide 3523 & 3524. She noted that there’s still a fair amount of risk associated with European debt. And the spreads of the bonds versus the German Bund are high and growing for the debt of Greece, Italy and Spain.

Slide 3523 & 3524. She noted that there’s still a fair amount of risk associated with European debt. And the spreads of the bonds versus the German Bund are high and growing for the debt of Greece, Italy and Spain.

Slide 3525. Inflation is rising about 2 – 4% and is not expected to become an issue in 2012.

Slide 3525. Inflation is rising about 2 – 4% and is not expected to become an issue in 2012.

Slide 3526. Hence the Fed funds rate remains biased toward expansion at close to zero, meaning the money is available to those who qualify - at historically low rates.

Slide 3526. Hence the Fed funds rate remains biased toward expansion at close to zero, meaning the money is available to those who qualify - at historically low rates.

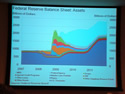

Slide 3527 & 3529. I found these slides of great interest, because it tells us what the Fed did to save the system from collapse about four years ago [beginning in 2007]. Essentially the Fed bought and continues to hold about $800 billion of MBS [mortgage backed securities – aka packages of peoples mortgages rolled up]. According to some estimates, this is between 3% - 4% of the U.S. residential mortgages. I have read that the effect of this move was that liquidity in the residential mortgage business didn't dry up - which if it had - the real estate market would have collapsed.

The other interesting thing to note here is that the Fed increased its holdings of U.S. Treasuries by about $600 billion. I have read that the reason for the increase is that the Fed wanted to push the money for those securities out into the market because one of the major problems facing the economy is the tightness of liquidity or available cash. By buying the Treasuries, it removes a place to store cash, thus forcing it back into the economy.

Economic Forecast For Queens 2012 - Questions & Answers

Some of the questions were answered in the narrative provided above. In the photo to your left is Gary Kesner, Chair of the LIC Partnership.

Some of the questions were answered in the narrative provided above. In the photo to your left is Gary Kesner, Chair of the LIC Partnership.

One of the comments was about housing. Ms. Rosen said that about 40 – 50% of housing originations are still underwater. This will continue to dampen the housing market.

Another audience member commented on inflation seen at the grocery store. Ms. Rosen said there’s some inflation there, but housing prices and rents will likely stay flat or fall, given the supply of housing relative to demand. And housing is 40% of the inflation number.

She thought that the current settlement by the government and the banks might reduce some uncertainty in the market and help it. In the photo to your right are Becky Barker, president of the Sunnyside Chamber of Commerce, and Joe Kenton of City Councilman Jimmy Van Bramer's office; both of whom attended the presentation.

She thought that the current settlement by the government and the banks might reduce some uncertainty in the market and help it. In the photo to your right are Becky Barker, president of the Sunnyside Chamber of Commerce, and Joe Kenton of City Councilman Jimmy Van Bramer's office; both of whom attended the presentation.

Ms. Rosen talked about the impact of local government cutbacks that would occur in the beginning of 2012, which is why their estimate is for a soft beginning of the year in 2012 and a pick up in the second half of the year.

U.S. Consumer Debt Service Ratio

One slide that I didn’t see was the debt service  ratio by consumers relative to their disposable income. The Fed publishes this ratio, which has fallen from 14% in Q3 2007 to about 11% in Q3 2011. Over the course of this past year, it fell an entire point, which is a further indication that Americans are making steady strides in reducing their debt service as a percent of their disposable income.

ratio by consumers relative to their disposable income. The Fed publishes this ratio, which has fallen from 14% in Q3 2007 to about 11% in Q3 2011. Over the course of this past year, it fell an entire point, which is a further indication that Americans are making steady strides in reducing their debt service as a percent of their disposable income.

In the photo to your right is the conference room prior to Ms. Rosen's arrival and speech.

U.S. Federal Government Debt - Queens NY

Another slide I didn’t see was regarding the national debt which at year end was $15 trillion. The growth in U.S. national debt has slowed from a high of 16% growth in 2008 when the financial crisis got ugly, to 8% growth in 2011. To put this in perspective, the current value of  U.S. debt now equals the output of the nation for a single year. The U.S. gross domestic product [GDP] was estimated to be $15 trillion in 2011.

U.S. debt now equals the output of the nation for a single year. The U.S. gross domestic product [GDP] was estimated to be $15 trillion in 2011.

Economic Outlook For Queens NY - Steady With Upside & Downside

All in all it was a very informative lecture / presentation. My general take away was that the economy is on much firmer ground than it has been over the past few years, but risks remain.

In the photo to your left is the LIC Partnership registration table.

Economic Risks To U.S. Economy - European Economies

The big event risk is how Europe addresses their debt crisis. And it is assumed that tight lending standards will be a constraint on large purchases, and a surplus of underwater real estate will continue to be a drag on job creation.

Economic Bright Spots - Stronger Balance Sheets, Fewer Layoffs & Growth

Economic Bright Spots - Stronger Balance Sheets, Fewer Layoffs & Growth

The bright spots are that consumers have reduced their debt service ratios by about 30% since 2007 including a 10% reduction in 2011. Exports remain strong (although there are risks as mentioned earlier), initial jobless claims are declining, and the economy in 2012 is expected to grow - even by the pessimistic economists.

So that was the current assessment as per the Federal Reserve. In the photo to your left, you can see that new construction appears to continue upward in LIC Queens. We wish you a healthy and prosperous 2012.

Click here to read our report about the NY Federal Reserve visit and Queens economic outlook in 2011 in Flushing.

Slide Show - Economic Charts Of Queens Business Presentation

Click here to go directly into the photo album containing the slides of Ms. Rosen's presentation - Federal Reserve economic forecast for Queens.

Sources: Rae Rosen NY Federal Reserve Economist, Bureau of Labor Statistics, Economist magazine, CBS.

2012-02-13

LIC Neighborhood - Long Island City Links

Click on these advertisements for promotions, discounts and coupons by retailers and restaurateurs in Long Island City LIC and nearby Queens.

Click this link to go to the:

Long Island City Neighborhood or LIC Business Directory

Long Island City Real Estate or Events & Things To Do In LIC

Restaurants In Long Island City or LIC Shops & Shopping

Site Search Tips. 1) For best results, when typing in more than one word, use quotation marks - eg "Astoria Park". 2) Also try either singular or plural words when searching for a specific item such as "gym" or "gyms".

$element(bwcore,insert_search,N)$

Click this link to search for something in our Queens Business Directory.

Click the log in link below to create an ID and post an opinion.

Or send this story to a friend by filling in the appropriate box below.