Queens Chamber Hosts Tax Seminar

Accountants From Mazars Provide Overview of Tax Changes

March 5, 2018 / Jackson Heights / Queens Neighborhoods / Queens Business / Queens Buzz NYC.

March 5, 2018 / Jackson Heights / Queens Neighborhoods / Queens Business / Queens Buzz NYC.

Last Thursday I headed over to the Bulova Corporate Center to attends a free tax seminar hosted by the Queens Chamber of Commerce. The seminar content was targeted toward small and medium sized businesses and their owners, in an effort to help folks navigate and plan their way through the new tax law changes.

The presenters included Mazars Partner James Wienclaw; and Senior Managers Donald Crotty and Michael Pappas. Mazars is an organisation specializing in audit, accountancy, tax, legal and advisory services. All three men are Certified Public Accountants [CPA’s] and the presentation took about two hours, including questions.

Tax Reform Plan of 2017 Includes Many Changes

Per an audience member request, we started with the Individual Tax Provisions. Generally the tax reform plan, entitled the Tax Cuts & Jobs Act, kept the seven tax rate brackets, but generally lowered the tax rates for all brackets  except the lowest bracket – which includes singles earning up to $9525. The plan did not extract the 3.8% tax which funds the Affordable Care Act [aka Obamacare].

except the lowest bracket – which includes singles earning up to $9525. The plan did not extract the 3.8% tax which funds the Affordable Care Act [aka Obamacare].

To partially offset the tax rate reductions, many itemized deductions were scaled back. Perhaps one of the most significant changes in deductions was that they set a limit for deductions for state and local taxes at $10,000.

Based on research I had done around the time of the Tax Reform plan enactment, this part of the tax plan will most negatively impact taxpayers in Democratic states like New York and California - both of which already contribute more to the federal coffers than they receive.

Click this link to view the OpEd report we posted just prior to the passage of the Trump Tax Plan to see an Atlantic Monthly chart showing what every state receives back on each dollar sent to Washington, D.C. [scroll down, it's near the end of the story].

As you can see in the Kiplinger map at right, as a general rule the Republican states are the net recipients of federal government funding, while the Democratic states are the net contributors into the federal coffers. There's some irony there, as it's generally the Republicans who complain the most about welfare.

We’ll post the rest of our report on this presentation later this week, and it's worth viewing as there were a number of major tax law changes.

- CLICK here to view the rest of the Queens Banks & Finance section.

$element(adman,groupad,Sectional Ad)$

$element(bwcore,article_picker,1179,Y,N,page_title_home,N)$

Trump Tax Plan: A Morally Bankrupt President’s Gift?

Are Billionaires Trump & Murdoch Bilking America’s Unborn Babies?

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Like many of you, I have been watching the Trump Tax plan make its way through Congress. While Trump and his cohorts were whipping together the tax package, I was doing research on the possible implications of some of their tax policy proposals.

According to an October 20, 2017 PolitiFact report [based on the plan at that time, which has since been modified],

"... in the first year of changes, the top 1 percent are projected to draw a little over half the tax savings. The threshold of 80 percent going to the top 1 percent is projected for the tenth year."

While directionally this statement is likely to hold [meaning the plan is biased toward the rich], the exact numbers as to how biased the Trump Tax Plan will be for the wealthy - based on the final bill - remains to be calculated.

In this report we look at a number of tax cuts included in the final bill including repatriation of overseas profits, reduction of the estate tax, reduction of the corporate tax and the blue vs red state tax increase. We include a review questioning why the Trump Administration is pushing this deficit expanding / debt increasing fiscal stimulus package - when we're in a full employment economy with rising wages. We also include how the Trump Tax Cut Plan has been treated propagandistically by Rupert Murdoch's media outlets, as he appears to personally and corporately benefit immensely from the tax cuts.

But before we begin, we take you on a quick review at some key characteristics and prior dealings of the man behind the plan – Donald J. Trump.

I. Character & The Art of the Deal - Or Steal?

In Donald Trump’s book The Art of the Deal, he says,

In Donald Trump’s book The Art of the Deal, he says,

"You can't con people, at least not for long. You can create excitement, you can do wonderful promotion and get all kinds of press, and you can throw in a little hyperbole. But if you don't deliver the goods, people will eventually catch on …”

Is the Trump Tax Plan a Tax Boondoggle for Billionaires?

Based on recent polls regarding the Trump Tax Plan, it appears the American people are of the opinion that this a very bad deal for them and their children. Perhaps this is why the Donald appears to be rushing through what appears to be one of the greatest tax billionaire boondoggles in modern history, while telling the public that this tax plan isn’t good for him ... or his super rich family and friends.

Always Pay Attention to a Person's Integrity or Lack Thereof

To listen to the Donald, you’d think he has always been a champion, if not a living martyr, of the middle and working classes of America. But the facts don’t always square with the Donald’s narratives. And the Donald, seems never to admit blame. That’s why he has continually lashed out at the media who inform the public about him – calling all, but Rupert Murdoch’s vast mass manipulation media [Fox News, Wall Street Journal & NY Post], Fake News. Trump and Murdoch live in the Bizarro World, where so much of what they say appears to be the truth turned upside down.

In the graphic at right, I modified Rupert Murdoch's Fox News website front page celebrating the passage of Trump Tax Plan - in which it appears that the bulk of the breaks will go to the super-rich, including the multi-billionaire Murdoch, who is a global propagandist and powerful Trump supporter. I call this Murdoch's propaganda payout and it appears to be HUGE.

Law and Crime, a web magazine funded in part by A & E Network, states in a February 16, 2016 report that Trump was named in at least 169 Federal Lawsuits. They went on to say that,

“The federal lawsuits that we reviewed date back to 1983 and involve everything from business disputes, antitrust claims and, more recently, accusations that Trump’s campaign statements are discriminatory against minorities. Some of the cases have been resolved, some were dismissed as frivolous, and others were privately settled. He’s been sued by celebrities, personal assistants, prisoners, people in mental hospitals, unions, and wealthy businessmen. Of course, Donald Trump has also done his fair share of suing as well.”

Slippery Donald – A Sales Promoter Who Must be Watched Carefully

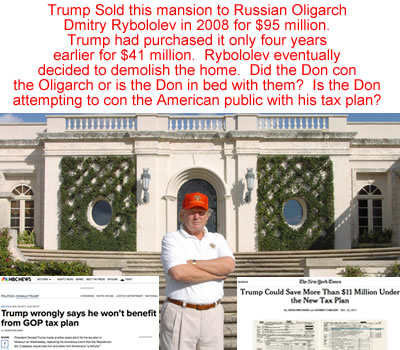

Watching Trump promote and sell his tax plan to the American public reminded me of a report about how the Donald sold a Palm Beach mansion - Maison de L’Amitie at 515 North Country Road - to Russian Oligarch Dmitry Rybolovlev in 2009. In a July 28, 2016 story in Politico, reporter Jose Lambiet says of the deal,

Watching Trump promote and sell his tax plan to the American public reminded me of a report about how the Donald sold a Palm Beach mansion - Maison de L’Amitie at 515 North Country Road - to Russian Oligarch Dmitry Rybolovlev in 2009. In a July 28, 2016 story in Politico, reporter Jose Lambiet says of the deal,

“This is what he [Trump] does with everything. He puts a little veneer on things and he doubles the price, and people buy it,” … “He’s [Trump] all smoke and mirrors—and that house was the proof.”

Dmitry, the Russian Oligarch, paid $95 million for what Trump had paid only $41 million just four years earlier. Dmitry is now reportedly planning to demolish the mansion.

The question is whether the Donald snuck one by the Russian Oligarch, or whether the Donald is in cahoots with the Russian Oligarchs, and this was an indication of such?

The graphic / photo at right shows Trump standing in front of the Maison de L'Amitie. In the lower left I added his claim that he wouldn't benefit from the Trump Tax Plan as reported by NBC News on November 29, 2017; while in the lower right is a December 22, 2017 New York Times analysis indicating that the Trump Tax Cuts might enable him to take advantage of $11 million in tax breaks.

II. Trump & The Russian Oligarchs

Are These Birds of a Feather Flocking Together?

A July 13, 2017 report by the New Republic informs us that,

A July 13, 2017 report by the New Republic informs us that,

“In 2015, the Taj Mahal [controlled by Donald J. Trump] was fined $10 million—the highest penalty ever levied by the feds against a casino [in years] - and [they] admitted to having “willfully violated” anti-money-laundering regulations.”

The report references the book, Red Mafiya, about the rise of the Russian mob in America, by investigative reporter Robert I. Friedman. It appears that the laundered money came from the Russian mob, and further in the story we learn a bit more about what appear to be the Donald’s shadowy business dealings with Russia.

“In April 2013, a little more than two years before Trump rode the escalator to the ground floor of Trump Tower to kick off his presidential campaign, police burst into Unit 63A of the high-rise and rounded up 29 suspects in two gambling rings. The operation, which prosecutors called “the world’s largest sports book,” was run out of condos in TrumpTower—including the entire fifty-first floor of the building. In addition, unit 63A—acondo directly below one owned by Trump—served as the headquarters for a “sophisticated money-laundering scheme” that  moved an estimated $100 million outof the former Soviet Union, through shell companies in Cyprus, and into investments in the United States. The entire operation, prosecutors say, was working under the protection of Alimzhan Tokhtakhounov, whom the FBI identified as a top Russian vor closely allied with Semion Mogilevich. In a single two-month stretch, according to the federal indictment, the money launderers paid Tokhtakhounov $10 million.

moved an estimated $100 million outof the former Soviet Union, through shell companies in Cyprus, and into investments in the United States. The entire operation, prosecutors say, was working under the protection of Alimzhan Tokhtakhounov, whom the FBI identified as a top Russian vor closely allied with Semion Mogilevich. In a single two-month stretch, according to the federal indictment, the money launderers paid Tokhtakhounov $10 million.

Tokhtakhounov, who had been indicted a decade earlier for conspiring to fix the ice-skating competition at the 2002 Winter Olympics, was the only suspect to elude arrest. For the next seven months, the Russian crime boss fell off the radar of Interpol, which had issued a red alert. Then, in November 2013, he suddenly appeared live on international television—sitting in the audience at the Miss Universe pageant in Moscow. Tokhtakhounov was in the VIP section, just a few seats away from the pageant owner, Donald Trump.

After the pageant, Trump bragged about all the powerful Russians who had turned out that night, just to see him. “Almost all of the oligarchs were in the room,” he told Real Estate Weekly.”

A Tax Plan for the new American Oligarchs?

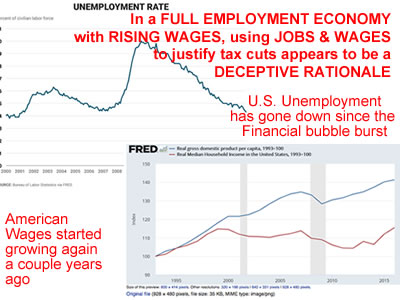

The U.S. has a Full Employment Economy & Wages are Rising

So Why is Trump Promoting Fiscal Stimulus in a Full Employment Economy?

Over the past few years the economy has been steadily adding new jobs, and wages have been rising. The unemployment rate is 4.1%, which means the U.S. is operating in a full employment economy. A full employment economy is defined as one where everyone who wants a job, has one, except those who are in transition. Normal transitioning is generally estimated at 5% of those who are employed. These transitioning unemployed workers are those workers who are making the change from school to jobs or vice versa, switching jobs or careers, moving from one locale to another, or making other relevant job or life changes such as illnesses etc..

Over the past few years the economy has been steadily adding new jobs, and wages have been rising. The unemployment rate is 4.1%, which means the U.S. is operating in a full employment economy. A full employment economy is defined as one where everyone who wants a job, has one, except those who are in transition. Normal transitioning is generally estimated at 5% of those who are employed. These transitioning unemployed workers are those workers who are making the change from school to jobs or vice versa, switching jobs or careers, moving from one locale to another, or making other relevant job or life changes such as illnesses etc..

So given we’re in a full employment economy where wages are rising, why are we incurring over $1 trillion in new debt to give the richest people in the nation / world tax breaks? The new jobs, higher wages argument seems deceptive as it just doesn’t seem to apply here.

Former NYC Mayor Bloomberg Says "This Tax Bill is a Trillion Dollar Blunder"

Former Republican Mayor Michael Bloomberg wrote an editorial dated December 15, 2017 on Bloomberg.com entitled "This Tax Bill is a Trillion Dollar Blunder".

Former Republican Mayor Michael Bloomberg wrote an editorial dated December 15, 2017 on Bloomberg.com entitled "This Tax Bill is a Trillion Dollar Blunder".

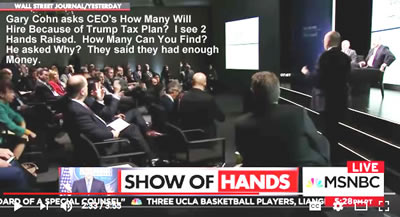

In the editorial Bloomberg cites his rationale, including an anecdotal poll taken by Trump Economic Adviser Gary Cohn who on November 14, 2017 asked CEO's to raise their hands if they planned any additional hiring. In the video of the event I saw only two hands raised, and the moderator goes on to ask, 'Why weren't more hands raised?'. Go to YouTube.com and type in the search 'gary cohn asks ceos to raise hands' to see the video for yourself. The answer is that the top CEO's are sitting on trillions in cash, so a tax break isn't going to change the investment landscape for them with respect to adding jobs.

Bloomberg concluded his editorial with the following statement.

"The tax bill is an economically indefensible blunder that will harm our future."

It’s also important to note that since the lows following the Great Recession of 2008 – 2009, wages have been going up between two and four percent, as measured on a quarterly basis.

- CLICK HERE to view the rest of our report on the Trump Tax Plan - Super Rich Bilk Billions from America's Unborn Babies.

Is Trump Pushing America into Arms Race With Itself?

Proposing $54 Billion Defense Budget Increase - Why?

February 28, 2017 / NYC Government / NYC Business / News Analysis & Opinion / Gotham Buzz NYC.

Tonight President Trump will address the nation regarding his plans for the U.S. One of the notable previews given by sources within the Administration is that Trump plans to increase Defense spending by $54 billion. I decided to take a quick look at some of the economic statistics to see if that appears warranted, especially vis a vis other priorities.

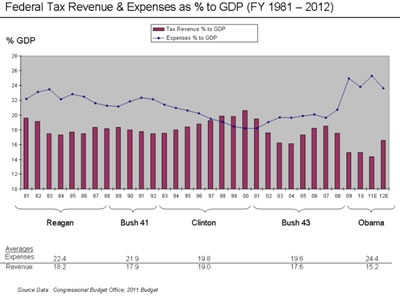

U.S. Government Deficits

The first chart [Congressional Budget Office] shows that the U.S. government has been spending more than it has been taking in. The gap widened in the wake of the September 2008 near financial meltdown, as tax receipts fell and fiscal stimulus [government spending] was needed to keep the economy going.

The higher levels of debt continued through the first term of the Obama Administration and then fell sharply back to Bush II era levels during the second term of the Obama Administration.

The net result is that near financial meltdown resulted in higher government deficits, which added to the overall U.S. government debt.

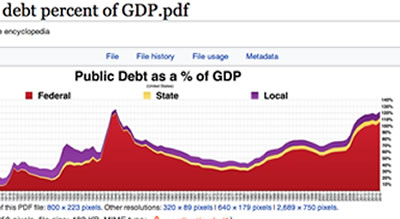

U.S. Government Debt

The second chart [Wikipedia] shows U.S. government debt relative to U.S. GDP. GDP is the acronym for Gross Domestic Product, which is a measure of the nation's economic output in goods and services.

The second chart [Wikipedia] shows U.S. government debt relative to U.S. GDP. GDP is the acronym for Gross Domestic Product, which is a measure of the nation's economic output in goods and services.

The chart shows that the overall U.S. government debt relative to GDP rose significantly in the wake of the 2008 near financial meltdown. Currently the U.S. debt level is equal to about an entire year of U.S. economic output.

Many economists think that the U.S. has an unhealthy level of debt as it doesn't provide much slack for unforseen circumstances, like the 2008 near financial meltdown or prolonged involvement addressing international crises.

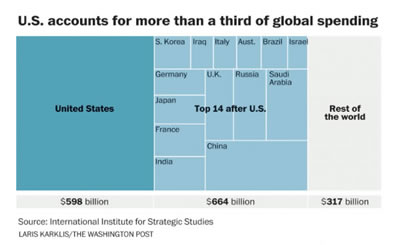

U.S. Defense Spending One Third of Global Total

About Equal to the Next 8 Nations Combined

Currently the U.S. appears to overspend on military operations vis a vis the rest of the world. The U.S. military accounts for one third of defense spending in the world and its budget is roughly equal to the military budgets of the next EIGHT leading defense spenders in the world.

Currently the U.S. appears to overspend on military operations vis a vis the rest of the world. The U.S. military accounts for one third of defense spending in the world and its budget is roughly equal to the military budgets of the next EIGHT leading defense spenders in the world.

You can see this in the chart at right which was created by the Institute for Strategic Studies and published in the Washington Post.

U.S. Economy Less than a Quarter of Global Total

About Equal to Only the Next 3 Nations Combined

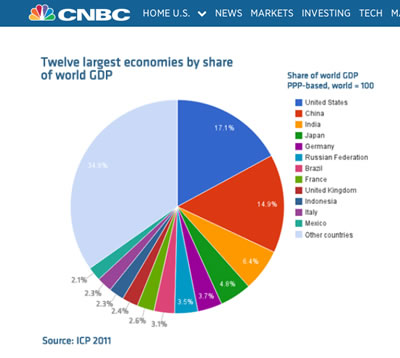

By contrast the U.S. economy represents less than a quarter of the global economy [versus a third of defense spending] and the U.S. economy is equal to the next THREE leading economies in the world [versus eight nations in military spending].

By contrast the U.S. economy represents less than a quarter of the global economy [versus a third of defense spending] and the U.S. economy is equal to the next THREE leading economies in the world [versus eight nations in military spending].

In the chart at right you can see the U.S. economy depicted in size versus the next eleven economies in the world. The chart was prepared by the International Comparison Program [ICP] which involves the World Bank in making its comparisons.

Does Trump Proposal to Increase Defense Spending $54 Billion Make Sense?

So my question is why is the president proposing to INCREASE defense spending, when we're spending so much more - relative to the size of our economy - than the entire rest of the world?

When private industry is asked to do so much more, with so much less, because it's possible with technology - does it really make sense to increase military spending?

It seems this sort of prolonged drain of resources - financed by borrowing from other nations on the backs of our children - actually weakens us, not strengthens us.

We'll find out how President Trump justifies this tonight. Next week I'll have more for you to consider about other national / economic priorities that the data indicates have far greater need for more resources than the U.S. military.

Isn't Trump the Greatest Negotiator in the World?

The Defense department spends well over a HALF TRILLION DOLLARS ANNUALLY. Is it possible that those in charge of our Defense spending are not good managers of the money they are given? Shouldn't former businessman President Trump teach them how to operate more leanly and better NEGOTIATE their contracts?

Aren't Security Risks Today Best Solved by Intelligence not Big Military?

It seems these days the real security risks are not so much military as they are terrorist. That would imply a change in strategy from spending on big hardware, to spending on intelligence. Unfortunately calm, thoughtful, intelligence appears to be in short supply at the White House these days.

Financing & Incentives For Business in Queens

LIC Partnership Hosts Panel of NYS & NYC Commercial & Industrial Incentive Experts

February 22, 2016 / Long Island City Neighborhood / Queens Banks Financing & Mortgages / Queens Business / Queens Buzz.

I attended a breakfast panel of New York State [NYS] and New York City [NYC] government incentives and financing experts. The panel included: Bryan Doxford, NY Business Development Corporation [NYBDC], Donald Giampietro, NYC Department of Small Business Services [NYC SBS], Jeffrey Lee, NYC Economic Development Corporation [NYCEDC], Jean Tanler, Business Outreach Center and Joseph Tazwell, of Empire State Development. The panel was moderated by Elizabeth Lusskin, President of the LIC Partnership, which hosted the event.

I attended a breakfast panel of New York State [NYS] and New York City [NYC] government incentives and financing experts. The panel included: Bryan Doxford, NY Business Development Corporation [NYBDC], Donald Giampietro, NYC Department of Small Business Services [NYC SBS], Jeffrey Lee, NYC Economic Development Corporation [NYCEDC], Jean Tanler, Business Outreach Center and Joseph Tazwell, of Empire State Development. The panel was moderated by Elizabeth Lusskin, President of the LIC Partnership, which hosted the event.

The purpose of the breakfast panel was to raise awareness of the municipal and state incentive programs and financing options available to the Long Island City business community. The programs are directed toward owners, managers and operators of local businesses with the intent of creating or enhancing jobs creation in the Long Island City neighborhood. Many of the programs are also available in other geographies in New York City and New York State.

Each panelist began by providing us with a summary of the incentives and financing with which their agencies or organizations can generally assist. This was followed by a brief Question & Answer session, and then a networking period.

You can search for the entities named above and contact them for further details about what programs they offer that might help you finance / save money while developing your business.

$element(bwcore,article_picker,1137-1118,Y,N,page_title_home,N)$

Queens Unemployment Continues To Best Metro Average

Drop In Unemployment Rate Continues Improving Trend

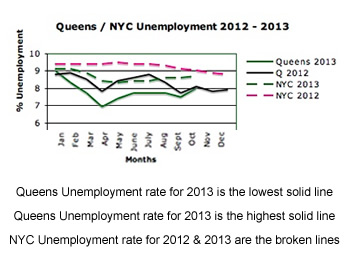

J anuary 28, 2015 / Flushing Neighborhood / Queens Business / Queens Buzz. In January of 2013 Queens unemployment rate was 8.9% and by the end of the year it had fallen to 6.7%. In January of 2014 Queens unemployment rate was 6.7% and by December of 2014 it had fallen to 5.7%.

anuary 28, 2015 / Flushing Neighborhood / Queens Business / Queens Buzz. In January of 2013 Queens unemployment rate was 8.9% and by the end of the year it had fallen to 6.7%. In January of 2014 Queens unemployment rate was 6.7% and by December of 2014 it had fallen to 5.7%.

Queens overall employment picture was better than the overall average for the NYC metropolitan area. In January of 2013 the NYC unemployment rate was 9.7% and by the end of the year it had fallen to 7.5%. In January of 2014 the NYC unemployment rate was 8.1% and by December of 2014 it had fallen to 6.4%.

Queens has been emerging as a business and residential destination given its proximity to Manhattan and its robust public transportation network.

Queens Economy On The Mend

Overall Employment Up, Unemployment Down & ... more

December 16, 2013 / Long Island City LIC / Queens Business / Queens Buzz. On Friday I attended the presentation of an Economic Snapshot of Queens by State Comptroller Thomas DiNapoli at Silver Cup Studios in Long Island City.

December 16, 2013 / Long Island City LIC / Queens Business / Queens Buzz. On Friday I attended the presentation of an Economic Snapshot of Queens by State Comptroller Thomas DiNapoli at Silver Cup Studios in Long Island City.

There was a large contingent of Queens government officials in attendance of the presentation - ranging in office from Borough President-elect, to City Councilmembers, to State Assemblypersons, to State Senators [see photo].

The news was good of course, as the Queens economy is on the mend. Unemployment is down, in spite of a growing labor force. And total jobs in Queens are estimated to be up 12,000 to about 882,000; while the private sector employment in Queens represents over a half million of that number. The event was sponsored by the Queens Economic Development Corporation.

We'll post more about the changes in the Queens economy later this week / month - including some contrarian points of view we picked up on the street. In the meantime you can click into a report we did about the different categories of Queens employment we did in March 2011, or into an update of Queens unemployment picture which we did in December 2012. And just last week we posted an update on Queens current unemployment statistics versus NYC and prior year. Enjoy.

$element(bwcore,insert_search,N)$

Queens Adds 12,000 New Jobs vs 2012

Unemployment Down & Labor Force Size Up

December 8, 2013 / Queens Business / Queens Buzz. Queens County continues to beat NYC handily with respect to having a lower unemployment rate. Queens had an unemployment rate of 8.0% in October 2013 versus an unemployment rate of 8.7% in NYC as a whole. Both of these numbers are improved versus 2012 when the NYC rate was 9.0% and the Queens County unemployment rate was 8.1%.

December 8, 2013 / Queens Business / Queens Buzz. Queens County continues to beat NYC handily with respect to having a lower unemployment rate. Queens had an unemployment rate of 8.0% in October 2013 versus an unemployment rate of 8.7% in NYC as a whole. Both of these numbers are improved versus 2012 when the NYC rate was 9.0% and the Queens County unemployment rate was 8.1%.

You can see in the chart to your right that the unemployment rates for both NYC [broken lines] and Queens [solid lines] in 2013 are lower than in 2012.

While the unemployment rates remain high relative to historic norms, part of the reason is that the labor force is growing again as people enter or re-enter the workforce in search of jobs in an improving economy. In NYC as a whole, employment has grown by nearly 65,000 positions versus October of 2012, and now stands at 3.7 million jobs. Queens employment is up about 12,000 new jobs and now stands at approximately 882,000 positions. Queens makes up about a quarter of the workforce of NYC.

$element(bwcore,insert_search,N)$

$element(bwcore,article_picker,1021,Y,N,page_title_home,N)$

How The Other Half Lives

September 23, 2013 / Long Island City Neighborhood / Queens Real Estate / Queens Buzz. I attended a reception hosted by TF Cornerstone in late September to celebrate the official opening of their fifth property. The building had been completed earlier this year and the first tenants had moved in sometime in May. I understand they've rented about 70% of the units, so they've been moving briskly.

September 23, 2013 / Long Island City Neighborhood / Queens Real Estate / Queens Buzz. I attended a reception hosted by TF Cornerstone in late September to celebrate the official opening of their fifth property. The building had been completed earlier this year and the first tenants had moved in sometime in May. I understand they've rented about 70% of the units, so they've been moving briskly.

I visited a couple of the units for rent, including a studio that started at about $2,300 per month and a two bedroom corner that likely rented for something like $5,000 per month [give or take several hundred]. To those of us who live in Queens, these are expensive units, but to those who live in Manhattan - given the views and amenities - these are good value. Like the headline says : )

We'll have more in late September / early October, including a photo slide show, of some of the new properties currently lining the LIC waterfront.

$element(bwcore,article_picker,1013-990,Y,N,page_title_home,N)$

Chhaya Hits A Home Run

4th Annual Home Buyer Fair in Jackson Heights

January 28, 2013 / Jackson Heights / Queens Business / Queens Buzz. The more I get to know about Queens, and the more familiar I become with the many immigrant communities to which Queens is called home, the more impressed I become with the intelligence of the American system and the immigrants who fuel the American dream.

January 28, 2013 / Jackson Heights / Queens Business / Queens Buzz. The more I get to know about Queens, and the more familiar I become with the many immigrant communities to which Queens is called home, the more impressed I become with the intelligence of the American system and the immigrants who fuel the American dream.

One of the American dreams is to own your own home. To that effect Chhaya [pronounced chi - ya], a non-profit organization in Jackson Heights, helped facilitate that effort at its fourth annual Home Buyer Fair on Saturday. Attendance of the Home Buyer Fair was at an all time high of several hundred, up from about 30 attendees at the first one, just four years ago.

The Home Buyer Fair featured a number of brand name lenders in the morning, and a whole host of non-profit / community minded organizations in the afternoon. The fair was open to everyone [we posted it in our Queens Events calendar in the business section], and provided attendees with a whole host of avenues for purchasing a home. Click here later today to read the rest of our report about the Chhaya Home Buyer Fair.

2011-03-27

$element(bwcore,article_picker,966-872-869,Y,N,page_title_home,N)$

$element(bwcore,article_picker,749-750-747-707-771-590,Y,N,page_title_home,N)$

Finance - Banks & Loans In Queens Related Info

Click this link for promotions, discounts and coupons in Queens.

Click this link to go to the Astoria Neighborhood / Long Island City LIC Neighborhood / Sunnyside Woodside Neighborhood News / Jackson Heights Elmhurst Neighborhood / Flushing Corona Neighborhood / Jamaica Neighborhood.

Archives - TBD

Site Search Tips. 1) For best results, when typing in more than one word, use quotation marks - eg "Astoria Park". 2) Also try either singular or plural words when searching for a specific item such as "gym" or "gyms".

$element(bwcore,insert_search,N)$

Click this link to search for something in our Queens Business Directory.

Click the log in link below to create an ID and post an opinion.

Or send this story to a friend by filling in the appropriate box below.